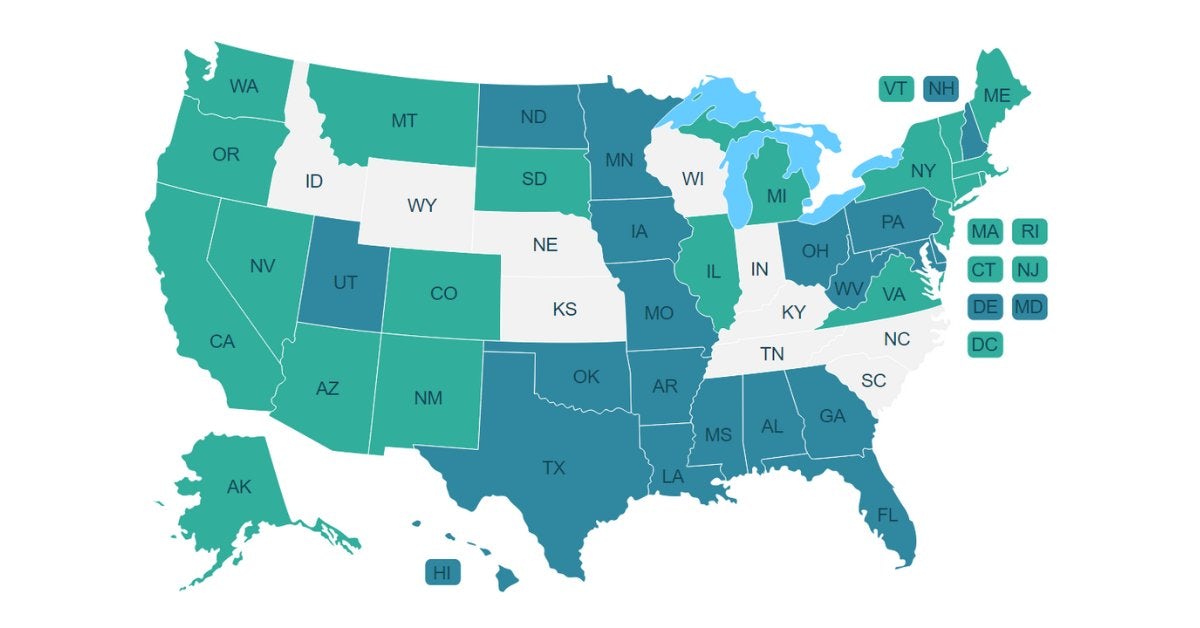

Medical: Yes

Recreational: Illegal

Reciprocity: No

Florida voters approved medical cannabis in 2016 and the new law went into effect at the beginning of 2017. Under the law, patients may purchase and possess up to 70 days worth of marijuana, or no more than four ounces of smokable marijuana. Edibles became available in August of 2020. Cultivation for personal use is not legal under Florida law.

How to Get a Medical Card in Florida

A prospective medical marijuana recipient in Florida must first be added to the Medical Marijuana Use Registry by their qualified physician.

After this step, they must then apply online for a card. They will be required to login and upload a copy of their Florida driver’s license or state identification card. If the card is for a minor patient, the parent or legal guardian must submit the documents on their behalf. The applicant must then submit the processing fee of $75 along with an online processing fee of $2.75.

According to the state of Florida, the processing time for the entire process takes 10 business days from the date of submission.

Qualifying Conditions

As per the state of Florida, the qualifying conditions that patients in Florida can receive medical cannabis for include:

- Cancer

- Epilepsy

- Glaucoma

- HIV/AIDS

- Post-traumatic stress disorder (PTSD)

- Amyotrophic lateral sclerosis (ALS)

- Crohn’s disease

- Parkinson’s disease

- Multiple sclerosis (MS)

- Medical conditions of the same kind or class as or comparable to the others listed.

- A terminal condition diagnosed by a physician other than the qualified physician issuing the physician certification. Chronic nonmalignant pain caused by a qualifying medical condition or that originates from a qualifying medical condition and persists beyond the usual course of that qualifying medical condition.

Where to Buy

Medical marijuana recipients can purchase cannabis at the state’s licensed medical marijuana treatment centers (MMTCs).

Reciprocity

According to Florida Senate Bill 8A seasonal residents can qualify for medical marijuana provided the applicant “temporarily resides in this state [Florida] for a period of at least 31 consecutive days in each calendar year, maintains a temporary residence in this state, returns to the state or jurisdiction of his or her residence at least one time during each calendar year, and is registered to vote or pays income tax in another state or jurisdiction.”

Taxes and Medical Marijuana in Florida

Medical marijuana and marijuana delivery devices used for medical purchases are not subject to Florida’s sales tax.

Sign up for bi-weekly updates, packed full of cannabis education, recipes, and tips. Your inbox will love it.

Shop

Shop Support

Support